| Program Name: | Investment Tax Credit (ITC) (IRC § 48) |

| Program Sponsor: | U.S. Internal Revenue Service |

| Program Type: | Tax Incentive |

| Technology: | Alternative Energy Generation/ Renewables; Energy Storage; Waste Management |

| Fuel: | Solar; Wind; Geothermal; Other Renewable Energy Resources |

| Eligibility: | Businesses |

| Cost: | N/a |

Description

The Renewable Energy Investment Tax Credit (ITC) is a provision under Section 48 of the U.S. Internal Revenue Code (IRC § 48) that provides a financial incentive for businesses investing in eligible renewable energy projects. Qualifying projects, including solar, wind, geothermal, and certain other renewable technologies, can receive a tax credit based on a percentage of the project’s eligible costs. This credit aims to stimulate the adoption of clean energy technologies by reducing the overall financial burden on investors and developers. Initially introduced as part of the Energy Policy Act of 2005, the ITC has been expanded and modified multiple times, most recently in the Inflation Reduction Act of 2022 (IRA).

The ITC can be claimed on federal corporate income taxes equal to a certain percent of the cost of eligible renewable energy property. Among other changes, the IRA restored the § 48 ITC to its full pre-phaseout rates and expanded the ITC to cover standalone energy storage.

Eligibility

Eligible technologies under the updated § 48 ITC include: Solar Water Heat, Solar Space Heat, Geothermal Electric, Energy Storage, Solar Thermal Electric, Solar Thermal Process Heat, Solar Photovoltaics, Wind (all), Geothermal Heat Pumps, Municipal Solid Waste, Combined Heat and Power (CHP), Fuel Cells using Non- Renewable Fuels, Tidal, Geothermal Direct-Use, Fuel Cells using Renewable Fuels, Microturbines, Offshore Wind, Biogas, Microgrid Controllers, Electrochromic Glass and Interconnection Property for certain small projects.

The equipment must be new, meaning the original use of the equipment must begin with the tax payer, or the system must be constructed by the tax payer, and must meet any applicable performance or quality standards in effect at the time when the equipment is acquired. The equipment must be placed in service in 2023 through 2034.

How the Program Works

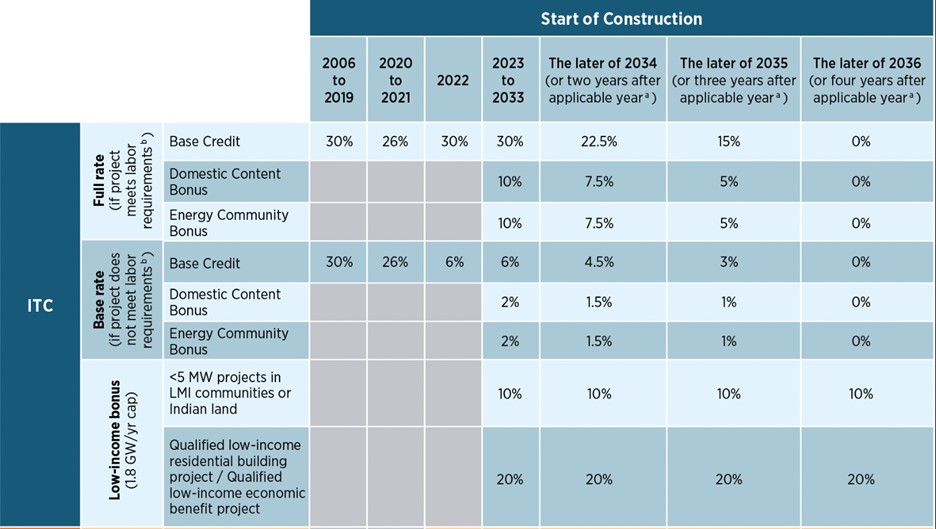

Under the IRA, the ITC operates through a two-tier rate structure. The first tier, known as the base credit, is set at 6%. Additionally, a second tier, the prevailing wage and apprenticeship labor requirements, provides an extra 24%, bringing the total base credit to 30%. To qualify for this enhanced credit, projects must adhere to prevailing wage and apprenticeship guidelines. Community solar projects of under 1 MW automatically receive the full 30%.

Beyond the base and labor credits, the IRA introduces bonus credits that further boost the available ITC. These include a 10% bonus for projects located in “energy communities,” a 10% bonus for meeting domestic content requirements, and a bonus (applicable only to the ITC) for projects benefiting “low-income communities.”

The IRA also outlines a phased reduction in the ITC percentage over time. Projects commencing construction between 2023 and December 31, 2032, are eligible for the full 30% tax credit (6% base rate + 24% if labor requirements met or for community solar under 1 MW) before decreasing to 26% in 2033, 22% in 2034, and ultimately expiring in 2035.

Source: U.S. Department of Energy

In addition to these changes, the IRA introduces two new mechanisms to monetize energy tax credits. The elective pay mechanism (also known as direct pay), defined under IRA § 6417, enables certain tax-exempt and governmental entities to opt for cash payments from the IRS instead of claiming tax credits. Meanwhile, the transferability mechanism, outlined in section 6418, allows most taxpayers (excluding tax-exempt and governmental entities eligible for direct pay) to sell their tax credits to an unrelated party in exchange for cash. This facilitates alternative options for renewable energy developers with limited tax capacity to utilize the ITC.

The existing § 48 credit will be generally replaced by a technology-neutral zero carbon emissions § 48E Clean Electricity Investment Credit in 2025 that is similar in structure to the existing ITC.

How to Apply

To claim the ITC, a taxpayer must complete and attach IRS Form 3468 to their tax return. Instructions for completing the form are also available.

Contact Information

Internal Revenue Service (IRS),

1111 Constitution Avenue, N.W.,

Washington, D.C. 20224

(800) 829-1040