| Program Name: | Production Tax Credit (PTC) (IRC § 45) |

| Program Sponsor: | U.S. Internal Revenue Service |

| Program Type: | Tax Incentives |

| Technology: | Alternative Energy Generation/ Renewables; Energy Storage; Waste Management |

| Fuel: | Solar; Wind; Geothermal; Biomass; Tidal; Landfill Gas |

| Eligibility: | Commercial/ Industrial clean energy production facilities |

| Cost: | N/A |

Description

The Production Tax Credit (PTC) is an inflation adjusted per-kilowatt-hour (kWh) tax credit for electricity generated by qualified energy resources and sold by the tax payer to an unrelated person during the taxable year. The duration of the credit is 10 years after the date the facility is placed in service. The Internal Revenue Code (IRC) § 45 PTC is an alternative to the IRC § 48 Investment Tax Credit. For more information, see EPA’s Renewable Electricity Production Tax Credit webpage.

Eligibility

Eligible technologies under the updated § 45 PTC include: Geothermal Electric, Solar Thermal Electric, Solar Photovoltaics, Wind, Biomass, Municipal Solid Waste, Landfill Gas, Tidal, Wave and Ocean Thermal.

To qualify for the revised PTC, a qualified facility must be placed in service in 2023 or later. A project is considered under construction if physical work of a significant nature has begun or if at least 5% of the total cost of the project has been incurred.

How the Program Works

The amount of PTC available to a taxpayer is calculated by multiplying a base rate that is adjusted annually for inflation by each kWh of electricity the taxpayer produces and sells to third parties during the year.

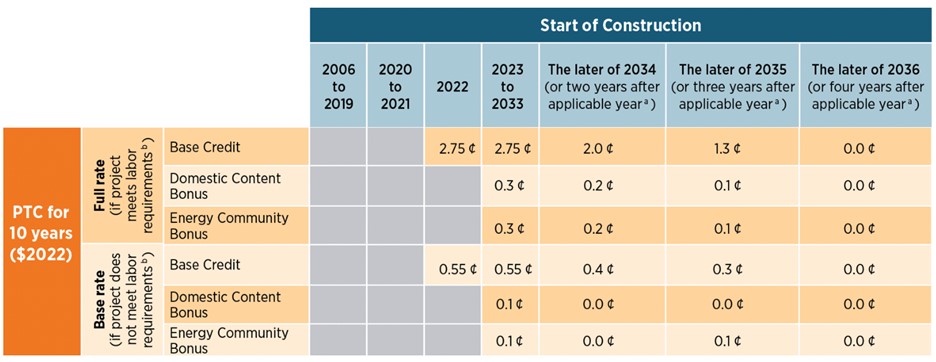

The unadjusted full rate is 2.75 cents per kWh for electricity produced from eligible facilities that meet the prevailing wage and apprenticeship labor requirements, or a base rate of 0.55 cents per kWh for projects that do not meet the labor requirements.

Beyond the base and full rates, the IRA introduces bonus credits – the Domestic Content Bonus and the Energy Community Bonus – that further boost the available PTC. Projects that meet the labor requirements receive an additional 0.3 cents per kWh for each bonus, while projects that do not meet the labor requirement receive an additional 0.1 cents per kWh for each bonus.

Source: U.S. Department of Energy

In addition to these changes, the IRA introduces two new mechanisms to monetize energy tax credits. The elective pay mechanism (also known as direct pay), defined under IRA § 6417, enables certain tax-exempt and governmental entities to opt for cash payments from the IRS instead of claiming tax credits. Meanwhile, the transferability mechanism, outlined in section 6418, allows most taxpayers (excluding tax-exempt and governmental entities eligible for direct pay) to sell their tax credits to an unrelated party in exchange for cash.

The existing § 45 credit will be generally replaced by a technology-neutral zero carbon emissions § 45& Clean Electricity Production Credit in 2025 that is similar in structure to the existing ITC.

How to Apply

To claim the ITC, a taxpayer must complete and attach IRS Form 8835 to their tax return. Instructions for completing the form are also available.

Contact Information

Internal Revenue Service (IRS),

1111 Constitution Avenue, N.W.,

Washington, D.C. 20224

(800) 829-1040